How To Fill Out A Check: Nowadays most peoples are using several digital money transfer methods like “NET BANKING, UPI, BANKING APPS” etc. Because these are the easiest and quickest way to transfer money. But this isn’t working in every way and all situations, like if you want to transfer money to someone who doesn’t have net banking or other money transfer services, or you don’t have payment details of another person then you can transfer the money through checkbook. You just need to fill the check sign on it and just pass it to the person.

Now let’s come to the question of how to fill out a check. Now filling a check is not so difficult for a regular person who done or doing several banking transactions or other banking works. It’s a bit difficult for those who don’t have any banking related knowledge or not much involved in any banking or transfer related works, but if they need to transfer the money then they have to know how to do it and if you one of them then we are here to show you how to fill out a check. To be noted that you must be aware of filling check because due to one misspelling or wrong word you have to cancel the whole check and have to pick a new one.

Check HMU Meaning Text

What Is A Check?

In general, a checkbook means that it’s a statement where you agree that you are transferring a certain amount of money to someone you are checking out. It gives the information to the bank to ensure that, whom you checked out can withdraw and direct deposit the money in their bank account from your account. You can call it an offline money transfer.

Before we start the process of how to fill out a check let’s discuss the pros and cons of using a checkbook.

PROS:

The first and the main advantage of transfer money through check is, you don’t need any payment details of a person to whom you want to transfer the money. Just simply fill the check and give it to the person.

Second is you don’t need a bank account to deposit the check, you can cash it very easily. Also, it is safe, because checks can’t be cashed by anyone, so it’s a lot safer than other money transfer process.

Another advantage is checks are traceable. Each time when you use a check for payments, the bank makes a copy so you can easily prove your payments later which you have done.

Know OFC meaning

CONS:

You need to be careful that you have a sufficient amount of money that you want to transfer to the person, otherwise, your check will bounce back and that is risky. To withdraw cash you need to wait for at least one or two days, it’s not as fast as digital money transfer.

You need to carry the check carefully if the check gets damaged then it will be problematic for you, especially for industrial purpose or official purpose, so be careful about that.

Now, everything has its pros and cons, now it’s up to you why and how you want to use it. Now let’s get started on the process of how to write a check.

How To Fill Out A Check 2023 [Updated]

Process To Fill Out A Check:

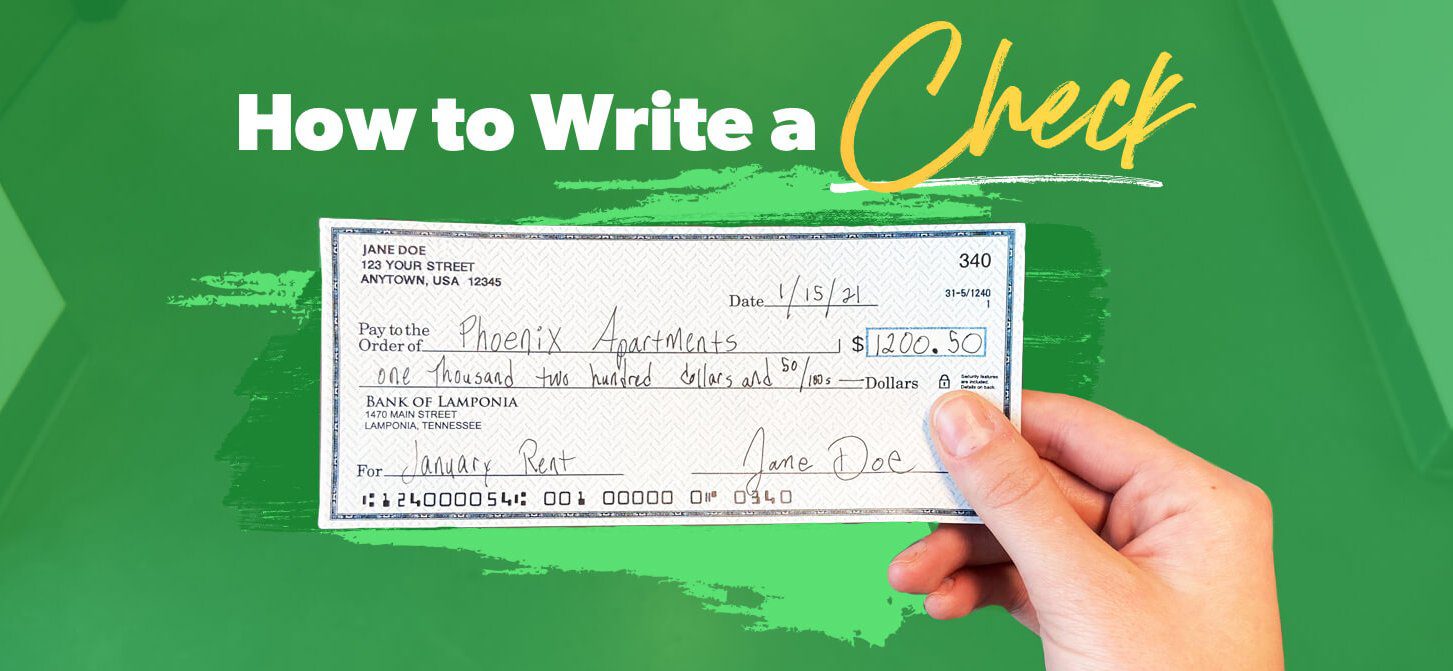

Before going to fill out the check just look at the check below and notice all the necessary fields that you need to fill out step by step. And next, we will go through all the single fields with a detailed guide.

Step 1. Write The Date:

The first thing you need to fill out is the date. It’s the most important step to be done because it will give the tracking information to you and your payees that when the payment will be done, and it also informs that when you fill the check.

So you just need to write the current date on that field which is located on the top right corner of the check. You can write the check like “November 3, 2020” or you can simply write the numbers “11/03/2020”. The standard date format of the United States is Month/Day/Year.

Real About What Does OP Mean

Step 2. Write Payee or Recipients Name:

“Pay to the order of” this field is located at the bottom of the left side of the check. This field is for the Payee, Whom you want to send the check. On that field just type the first and last name of that person to whom you want to send the money, if you are writing the check for any company or organization then type that name here.

Make sure that you have written the name of the payee correctly because if you misspelled it then you have to cancel the check or the check will not go through.

Step 3. Filling Out The Amount in Numbers:

In the check there are two areas to fill the amount, one is where you need to fill the number of the amount and the other area is for filling the amount with words. First, you need to fill the amount in numbers.

You will find this spot on the upper right side of the check (in “box shape”) which is just next to the Payees name field. So just enter the amount in numbers, for example, “$100”. Make sure you enter it properly and clearly so that the ATM machine or the bank can read the numbers clearly.

Step 4. Write The Amount in Words:

As we mentioned before that you have to fill out the amount in words also. Now you might be thinking why in words? It is because it ensures that you have entered the correct amount that you want to transfer, also it will prevent someone to increase the amount themself. So overall it’s for safety purposes.

You will find this field under the “Pay to the order of” line. Just write the amount in words that you have written in the number field, for example, “one hundred dollars”. One important thing is, just add “cents” word after the amount you entered, for example, “one hundred dollar cents”, it’s for additional clarity.

Read more About CTFU

Step 5. Writing A Memo:

Writing a memo is optional but it is useful, this step is for the reason of your payment. Like if you are paying an electricity bill you have to write “Electric bill” or if donating to someone then write “Donation” or if it is for some organization then write the name of the organization or any individual then write the reason for the payment.

Although on the electric bill payment, the company will ask you to put the account number of yours in the Memo field of the check. So if you want to fill the memo section just head over to the left bottom side of the check, and give your proper reason for the transaction.

Step 6. Sign Your Check:

This is the final step to fill out a check. This is the most important step because, by the signature of yours, you agree that all the information you have put on the table is correct. Without your signature the whole check is useless.

So make sure you done your signature properly and clearly, and make sure that this signature matches your bank account signature because it’s very important. Just head over to the bottom right side of the check and give your signature and you are all done.

So this is the simple step by step guide to writing a check properly. Now you need to clarify a few more things related to filling out the check, which we will discuss below.

Record Your Payment Details in Your Check Register:

Well if you using a checkbook for the first time then this will help you a lot. Make a list of all your transaction you have made through your checkbook in a check register. You will find the check register in the back of your checkbook. If you didn’t find the check register, then make a spreadsheet on paper and write all of the essential details from your checkbook.

By doing this you can calculate your spending so that your check won’t bounce back. You can track your transactions when and whom you have paid how much amount. It’s also important to record all the payment details because your bank account will have the same amount until your payee cashes or deposit the amount in his bank account. It will give you a clearer image that how much amount you should have in your account until the transaction is over.

Security Tips To Writing A Check:

When you write a check there are few things and safety matters need to be followed. After you signed the check, there are multiple chances to get lost checks. So it will be great if you make it difficult for thieves that they can’t fraud you.

- Make the writing permanent by using a pen instead of using a pencil when you filling your check. Because pencils can be erased easily and it will be easy for someone to change the amount and the payee name. It’s obvious that most of you will definitely use pens, but still, there is a chance few of us can willing to use pencils, so don’t use a pencil.

- Secondly don’t leave the payee and amount section blank after you sign the check. Many of us are willing to do this because sometimes we are not sure about the name and amount, so we pass the check after sign on it. It’s a very risky step; if you don’t have the proper details then confirm it then fill it with a pen. You can’t let someone unlimited access to your account.

- If you want to add paper records of your every check, then use carbon copy checkbooks. In those checkbooks, you will get a thin sheet on every check page. You just need to insert a carbon copy under the check which you want to write. This way you will have the records of each check you have used. And you can monitor them any time if it needs to.

- Signature consistency is also important, although still many of you don’t have a suitable signature. Some people signed their credit card slips and checks with horrible images. It’s very important to use proper and consistent signature in your check and card slips, it helps the bank and you to identify frauds easily. It will be difficult for someone to fraud with you as well as easy for you to prove any fraud if the signature doesn’t match. So the proper signature is very important.

- Don’t leave any space on the amount section; try to cover the whole area of the section that anyone can’t add more numbers behind and before the amount. It will ensure that it’s hard to enter any extra number. If there any space left before and after writing the amount, just draw a line on the empty space.

- If- possible, don’t write a “check payable to cash”. Because it’s very risky as a signed blank check, it’s like you are carrying a bunch of cash with you. If you want cash then use your ATM card.

- Make sure you have a proper balance on your account before filling up any check. Because if you don’t then your check will bounce back. And it’s very risky, you can face legal issues. So make sure to check your account statement.

- After writing the check read all the fields twice to check if you have done any mistakes or not, especially the payee and amount section. Check all spellings are correct or not.

Some Identification Of Check Numbers:

- This is called the check number. Every check of your checkbook has a check number. Check number helps to track payments.

- This section is the address of the check holder

- That is called a routine number which is used for electronic transactions.

- That is called the checking account number and this is for the indication of your specific bank account.

Must Read INB4 Mean

Final Words: How To Fill Out A Check

Here are the full details of filling out the check properly, hope it will help you if you are using a checkbook for the first time. Although using checks for money transactions is might be beneficial in some way, but there are also some risk factors that can happen to you. It’s obvious that using other money transfer methods is more useful than using a checkbook, but as we say earlier that it’s up to you which is best for you depends on the purpose. Hope you found this article helpful, if so then do share with those who also want a guide to filling out their check. If you have any questions regarding how to write a checkbook then do comment we will reply to you as soon as possible.